Expanded Tools Make It Easier Than Ever for Coloradans to Save for Retirement

Sept. 24, 2025 (DENVER) — The Colorado SecureSavings Program announced a major update to its saver and employer portals with the introduction of multilingual functionality and an enhanced mobile experience as part of its mission to expand access to retirement savings.

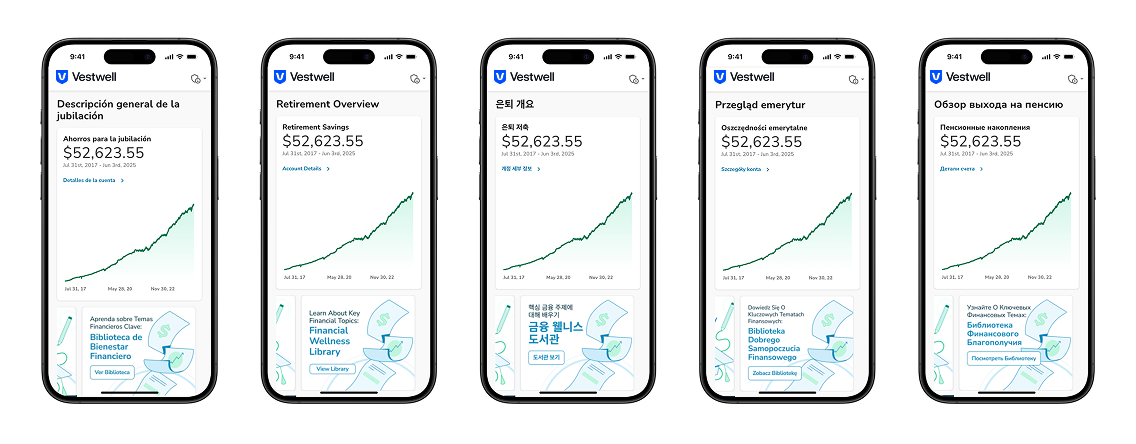

Vestwell, the program’s administrator, has rolled out 18 new languages on its platform. Languages available include Spanish, Mandarin, Korean, Russian, Italian, Portuguese, French, Polish, Cantonese, Arabic, Yiddish, Bengali, Haitian Creole, Urdu, Vietnamese, Tagalog, Farsi, and Armenian.

“Our goal with Colorado SecureSavings is to make saving for retirement simple, accessible, and inclusive,” said Colorado State Treasurer Dave Young. “These new tools help break down language barriers and offer the flexibility Colorado workers need to take control of their financial futures.”

Since launching in 2023, the program has enrolled more than 17,000 employers and nearly 90,000 savers who have accumulated over $158 million in retirement assets. The mobile enhancements build on this momentum and pave the way for greater participation and savings.

“We’re proud to make the Colorado SecureSavings Program even easier to use by meeting savers where they are,” said Colorado SecureSavings Program Executive Director Hunter Railey. “Every worker in Colorado deserves the opportunity to build a secure financial future, and these new tools ensure no one is left behind.”

Savers can update their preferred language directly within their account settings or by selecting the language icon located in the portal footer. Once a language is chosen, the entire portal, along with key documents like the Program Disclosure Booklet (PDB), is presented in the selected language for all future logins. Language preferences can be changed at any time.

Vestwell also offers a mobile app, putting a modern savings platform directly in the hands of Colorado workers. The app provides on-demand access to retirement savings and additional tools, empowering users to manage their financial futures on the go, anytime, anywhere.

“Vestwell designed this initiative to help our partners close the savings gap. By bringing multilingual access and a mobile-first experience to the Colorado SecureSavings program, we’re breaking down barriers and delivering tools that meet the needs of today’s modern workforce, in the languages Coloradans know best,” said Aaron Schumm, Founder and CEO, Vestwell.

The Colorado SecureSavings Program addresses a critical need: providing retirement plans to the 1.4 million Colorado workers who lack access to one through their employer. Colorado SecureSavings Program is closing the retirement gap, giving workers an automatic way to save with every paycheck.

Businesses that have been operating for two or more years and employ five or more workers must offer a retirement plan–whether through Colorado SecureSavings or their own private plan. The Department will soon contact qualifying businesses and encourage them to enroll in the program or certify an exemption before year-end.

For more information, visit coloradosecuresavings.com.

###

About the Colorado Department of the Treasury

The Colorado Department of the Treasury is the constitutional guardian of the public’s funds. It is the Treasury’s duty to manage and account for the taxpayers’ dollars from the time they are received until the time they are disbursed. The Treasury’s staff is committed to safeguarding and managing the people’s monies with the same diligence and care as they do their own. For more information, visit colorado.gov/treasury.